Responsive - Reliable - National

Car Accident Claims

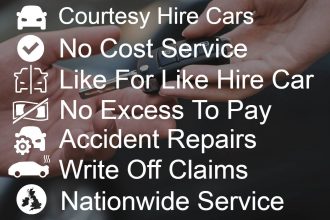

Accident Courtesy Vehicle - Accident Damage Claim Services & Like For Like Courtesy Vehicles

Open 24 Hours - National Service

- Accident - Vehicle Claims

- Repair - Write Off Claims

- Vehicle Accident Recovery

- Like For Like Courtesy Vehicles

- Open 7 Days A Week

- Standard Vehicles

- Prestige Vehicles

- Performance Vehicles

- Vans & Commercials

- Motorbikes & Scooters

- Taxi's & Plated Vehicles

Car Accident Claims

Vehicle Damage Claims After Non Fault Car Accidents

Non Fault Car Accident?

We Are Ready To Help

If you have been involved in a non-fault car accident we are ready to assist. We provide an alternative vehicle claims route to your insurance company.

The advantage of claiming with an independent car accident claims service:

- No Excess & Nothing To Pay

- No Claim Made Against Your Policy

- Full Control Of Your Vehicle Claim

- You Select The Repair Centre

- You Agree Write Off Values

- Protect Your Claims History

- Single Point Of Contact

Hassle Free Alternative To Your Insurance

We provide a hassle free alternative vehicle damage claim route to your insurance company.

Did you know that regardless of your insurance cover type, comprehensive or third party, you are entitled under what is know in UK law as ‘tort law’ to claim at no cost, any loss you have incurred as a direct result of the accident. This includes the provision of a like for like courtesy vehicle whilst your own vehicle claim is processed.

It’s Your Right To Select A Vehicle Claim Service That Meets Your Requirements

It is your right to select any vehicle claim company you feel offers the best service and meets your requirements. You do not have to use your insurance companies services and should not be pressured to do so, if you are not happy with their service offering you have options. However most insurers do offer an excellent service so always research all your options to find the best solution.

Car Insurance Claims

Whilst many insurance companies may offer great vehicle claims and courtesy hire car services, an equal amount do not. Their customers often experience long call waiting times, unhelpful and uninformed call centre staff, and what is right for the insurance company is not always right for you.

If you are not happy with the vehicle claim service offered by an insurer or simply wish to claim directly from the at-fault insurer we are ready to help.

Why We Are Better

We offer an alternative option to your insurance company for your vehicle accident damage claim and courtesy car provision after the accident. With our customer-focused vehicle claims service, we appoint an individual vehicle damage claim handler to process your vehicle claim to its swift conclusion. This means you have a single point of contact throughout the entire process, they will ensure the claim is processed quickly and efficiently whilst keeping you fully updated with the vehicle claims progress.

The key difference with our service is simple, we act upon your instruction and in your best interest, not the instruction of an insurance company. Customers agree vehicle valuations and the option of repair centre is entirely their choice. With this simple policy, we ensure that all our customers receive efficient accessible customer service throughout the entire vehicle claim process and through to its swift conclusion.

How The Car Accident Claim Process Works

We provide a simple one-call service to register your vehicle claim or courtesy hire car request, we do the rest. You will remain fully informed of your vehicle claims progress throughout the process.

Once we are appointed, we arrange a post-non-fault accident courtesy vehicle and vehicle recovery following your requirement. We then immediately set to work on progressing your vehicle claim.

Our Vehicle Claim Process

First on the agenda is carrying out an engineers inspection of your vehicle. This will be carried out in person by an engineer who is appointed to assess the vehicle for its repair status, or its pre-accident value. Repairable vehicles will have a detailed repair cost report produced, written off vehicles will be fully valued in accordance to current comparable vehicle replacement values. The detailed valuation is reports are produced and presented for your approval.

Once the report is produced and you have agreed to any valuation, we submit the claim for your losses to the at-fault driver’s insurance company. If your vehicle is repairable we will first agree on a repair centre with you, then authorise your vehicle repairs directly to your chosen repair centre.

Vehicle Write Off Claims After Non Fault Car Accidents

Should your vehicle have been damaged to the point of its total loss write off status as a result of a non-fault car accident, we are ready to help. We correctly and accurately value your vehicle and look after your best interests first. We instruct our non-fault accident courtesy car team to arrange an immediate courtesy car if required, and the vehicle claims process begins with your vehicle inspection.

The Correct Way To Process A Vehicle Write Off Claim

It’s essential your write off claim is processed correctly to ensure you receive the correct valuation of your vehicle. The goal is to claim an accurate vehicle write off value that will enable you to purchase a comparable vehicle to your original vehicle, and the key detail, without suffering any further financial loss in doing so. Put simply you get paid out the correct money to replace the vehicle.

Write Off Vehicle Valuations

With many insurers using book values or desk engineers to produce estimated write off valuations, there can be a risk of incorrect valuation in current times. This can not only result in further financial loss, an issue especially problematic for financed vehicles but can also affect the provision of a courtesy car if you dispute the insurance companies valuation, often leaving you with no courtesy car and not correctly paid out. That is why we process write off claims with care and in detail to ensure you receive the correct valuation from the outset, and the right settlement outcome quickly and efficiently.

Independent Vehicle Inspections

We instruct an independent vehicle inspection engineer to assess your vehicle and produce a detailed report covering the vehicle; pre-accident condition, age, mileage, service history and full vehicle specification. The engineer then conduction a detailed market appraisal to produce an accurate vehicle valuation that accounts for current market conditions in place at the time of the accident.

The objective is to produce an acceptable market value that will enable the replacement of your vehicle at no extra expense to you as the owner. For immediate car accident claims help contact our team today.

Repairable Vehicle Claims After Non Fault Car Accidents

Claims are made directly to the at-fault driver’s insurance company. To claim for vehicle damage we begin by arranging an inspection of your damaged vehicle. If the vehicle is not in road-legal condition due to the accident damage we will arrange an immediate like for like courtesy vehicle to get you back on the road. For drivable vehicles, we will arrange a like for like courtesy vehicle during the period of repair.

Vehicle Repair Assessment

An engineer will inspect your vehicle and carry out a detailed assessment of the condition of the vehicle. The engineer will then produce a detailed appraisal of the vehicles repair requirements, including full costs valuation. This will detail all parts, materials, labour rates and time required to carry out vehicle repairs to manufacturer standards. For newer vehicles the report will also include any loss in value the vehicle may have sustained as a result of the accident, this loss can be claimed for as well as the repair cost itself. Repairs are carried out at a garage of your choosing.

Detailed Vehicle Accident Repair Report

The engineer’s report will be sent to the vehicle owner and the appointed repair centre of the owners choosing. Once the content of the report is agreed upon we authorise repairs following the reports valuations. We also submit the report to that at-fault insurance company for their settlement.

The at-fault driver’s insurance company will cover the cost of all accident-related damage and full repair costs, In addition, any devaluation of value (diminution claim) your vehicle may have sustained as a result of the accident damage and resulting repair. For car accident claims assistance contact a member of or team.

Vehicle Accident Damage Claims At No Cost To You Or Your Insurance

Find Out If We Can Help You Now

Car Accident?

Vehicle Claim Questions

How To Claim After A Non-Fault Car Accident

Claiming after a non-fault car accident is a simple process. Each loss you incur is a separate head of claim, for example, vehicle damage, property damage, loss of earning or business, compensation for personal damages to name a few.

Each head of claim is assessed and the quantified loss is recovered from the at-fault driver’s insurance company.

How We Can Help

We provide an alternative route to claim your vehicle damage or vehicle write off value rather than using your insurance company. We offer a simple one-call service to report and register your vehicle damage claim. Being independent we act in your best interest throughout the vehicle claim process.

What to do next?

Call our 24-hour vehicle claim helpline and a member of the team will explain the claim process, answer your questions and arrange all services required.

Call us on: 0800 860 0171.

Claim Your Losses After A Non-Fault Car Accident

You can claim for a temporary replacement hire vehicle, property damage, or any financial loss you may have incurred as a direct result of the accident.

You can also claim for personal damages via a solicitor or a suitable legal expenses product you may have. However often a solicitor is provided by your own insurance company and this can be the most cost-effective way to claim dependent upon your policy type. Always make your investigations to discover your options and find the most cost-effective and expert service available to you.

Once liability is accepted by the at-fault driver’s insurance company claims for vehicle damage will usually be settled within 7 to 14 days.

Repairable Vehicle Claims

Vehicle repair authority is usually given within a 2- 7 day time frame following your vehicles engineers inspection report.

Write Off Vehicle Claims

Write off values are usually paid out within 7 to 14 days from your acceptance of your vehicle write off value.

There is policy excess required as the claim is presented directly to the negligent drivers insurers.

The vehicle loss / Vehicle repair claim together with the cost of the any temporary vehicle is also claimed from the at-fault driver’s insurance company.

Write Off Value Claims

Vehicles should be valued correctly to establish their current market value. When claiming for a vehicle after a non-fault accident you are entitled to claim the market value for a vehicle. However, if the vehicle is brand new the original cost can be recovered.

For vehicles that are not brand new, you are entitled to claim back their current market value at the point of loss. Market value is somewhere between retail and trade value. It’s often described as what you might find the equivalent vehicles market value for a private sale example.

Accurate Valuation

To value a vehicle correctly multiple examples of the equivalent vehicle will be found as market examples. A vehicle engineer will also inspect your vehicle, taking into account the vehicles age, mileage, pre-accident condition and service history to assess the condition. The vehicle model and its build specification are also considered valuation.

All these factors are then combined and discussed with the vehicle owner to enable a final agreed valuation.

A simple book value is more often simply not applicable given the wide variation in single-vehicle model specification. Cars highly personalised with the almost endless optional extras vehicles can be ordered with. When combined with the varied approach different individuals take to vehicle maintenance and car care book valuations are often not accurate.

Car Accident?

Vehicle Claim Questions

How To Claim After A Non-Fault Car Accident

Claiming after a non-fault car accident is a simple process. Each loss you incur is a separate head of claim, for example, vehicle damage, property damage, loss of earning or business, compensation for personal damages to name a few.

Each head of a claim is assessed and the quantified loss is recovered from the at-fault driver’s insurance company.

How We Can Help

We provide an alternative route to claim your vehicle damage or vehicle write off value rather than using your insurance company. We offer a simple one-call service to report and register your vehicle damage claim. Being independent we act in your best interest throughout the vehicle claim process.

What to do next?

Call our 24-hour vehicle claim helpline and a member of the team will explain the claim process, answer your questions and arrange all services required.

Call us on: 0800 860 0171.

Claim Your Losses After A Non-Fault Car Accident

You can claim for a temporary replacement hire vehicle, property damage, or any financial loss you may have incurred as a direct result of the accident.

You can also claim for personal damages via a solicitor or a suitable legal expenses product you may have. However often a solicitor is provided by your own insurance company and this can be the most cost-effective way to claim dependent upon your policy type. Always make your investigations to discover your options and find the most cost-effective and expert service available to you.

Once liability is accepted by the at-fault driver’s insurance company claims for vehicle damage will usually be settled within 7 to 14 days.

Repairable Vehicle Claims

Vehicle repair authority is usually given within a 2- 7 day time frame following your vehicles engineers inspection report.

Write Off Vehicle Claims

Write off values are usually paid out within 7 to 14 days from your acceptance of your vehicle write off value.

There is no cost to pay or policy excess required.

The vehicle claim service is paid for by the at-fault drivers insurance company.

Write Off Value Claims

Vehicles should be valued correctly to establish their current market value. When claiming for a vehicle after a non-fault accident you are entitled to claim the market value for a vehicle. However, if the vehicle is brand new the original cost can be recovered.

For vehicles that are not brand new, you are entitled to claim back their current market value at the point of loss. Market value is somewhere between retail and trade value. It’s often described as what you might find the equivalent vehicle market for as private sale.

Accurate Valuation

To value a vehicle correctly multiple examples of the equivalent vehicle will be found as market examples. A vehicle engineer will also inspect your vehicle, taking into account the vehicles age, mileage, pre-accident condition and service history to assess the condition. The vehicle model and its build specification are also considered valuation.

All these factors are then combined and discussed with the vehicle owner to enable a final agreed valuation.

A simple book value is more often simply not applicable given the wide variation in single-vehicle model specification. Cars highly personalised with the almost endless optional extras vehicles can be ordered with. When combined with the varied approach different individuals take to vehicle maintenance and car care book valuations are often not accurate.

Call Back Request

Car Accident Claims Service

Car accident claims and courtesy car service after non fault car accidents. With full UK service cover, courtesy vehicles are available for delivery directly to you today.

We offer full incident support after a non fault car accident. With vehicle accident recovery, vehicle damage assessment, and a manufacturer approved repair network.

Need car accident claims help together with a courtesy car after the accident? ACC can help you today.

- No Excess To Pay

- Accident - Vehicle Claims

- Repair - Write Off Claims

- Vehicle Accident Recovery

- Like For Like Courtesy Vehicles

- Open 7 Days A Week